Current classification Limited Partnerships

Under current Dutch classification rules, a limited partnership is generally considered to be transparent for Dutch tax purposes if for the admission or substitution of a limited partner, unanimous consent of all limited partners and the general partner is required. Therefore, to qualify as transparent for Dutch tax purposes, the limited partnership agreement (“LPA”) should include a specific clause that prescribes such unanimous consent from all partners. As the LPA’s of foreign limited partnerships generally do not contain such clause, foreign limited partnerships are under the current qualification rules often considered opaque for Dutch tax purposes while considered tax transparent in other countries. Hence, this results in so-called hybrid mismatches.

New classification Dutch Limited Partnerships

From 1 January 2025, all Dutch limited partnerships (i.e. CV’s) should become transparent for Dutch corporate income tax (“CIT”) as well as for personal income tax (“PIT”), dividend withholding tax (“DWT”) and conditional withholding tax purposes), regardless of what is stipulated in the LPA regarding the entry and replacement of limited partners. Hence, the consent requirement will be removed. Therefore, the distinction between the open CV (opaque for Dutch tax purposes) and the closed CV (transparent for Dutch tax purposes) will disappear.

Classification Foreign Legal Entities

Under current Dutch law the “legal form comparison” is applied to qualify foreign legal entities. Under the legal form comparison, the most similar Dutch equivalent of a foreign legal entity is used to determine the qualification of the foreign entity for Dutch tax purposes. Entities that qualify as an open CV under the current law will generally transform to a tax transparent entity under the new rules as of 1 January 2025. Obviously, this may have significant impact on investment structures and investors that make use of Dutch or foreign partnerships.

Priority rule FGR

Based on recent replies from the Ministry of Finance on questions from the Dutch Association of Tax Lawyers, a so-called priority rule will apply, which stipulates that partnerships are opaque if they qualify as mutual funds (Fonds voor Gemene Rekening, or “FGRs’).[1] This rule ensures that the open FGR qualification takes precedence over the legal form qualification. This is particularly relevant as foreign partnerships may qualify as both a partnership and a FGR. Based on the legal comparison rule such partnership would generally be considered tax transparent under the new law, while it would be considered opaque if it qualifies as a FGR. Hence, as a result of the priority rule, in such case the foreign partnership will be treated as an opaque FGR instead of a tax transparent partnership. Please note that in case a partnership is tax transparent under the current law, the priority rule could have the effect that it becomes opaque as from 2025 (see example 3). In such case the participants that are subject to Dutch profit tax (i.e. corporate income tax or personal income tax) are considered to realise hidden capital gains and goodwill that are attributable to them until 1 January 2025. There is no transitional law in this respect.

Per 1 January 2025, a partnership will be considered a FGR if:

- the entity is a collective investment fund as defined in Article 1:1 of the Dutch Financial Supervision Act (Wft) or an ICBE investment fund;

- the participation rights are tradable, which is only not the case if the sale of these rights is only allowed to the fund itself (the so-called inkoopvariant). In this respect, the state secretary announced transitional law for the situation in which a partnership that is tax transparent under current law intends to include the inkoopvariant in its LPA to ensure that it will remain tax transparent under the new law; and

- the entity does not carry on a material business enterprise for Dutch tax purposes.

The law indicates that only mutual funds as defined under the AIFM Directive or UCITS Directive will qualify as FGRs. This is to prevent family investment funds from being treated as FGRs, aligning with the legislative intent to treat them as tax transparent.

Examples

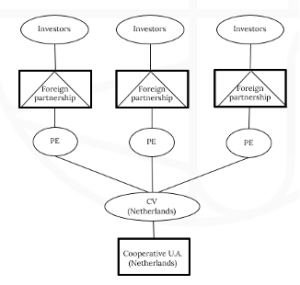

- Foreign partnership investing in Dutch Fund

Foreign investors are investing in a Dutch investment fund (i.e. a Dutch closed CV, the “Fund”) through a foreign partnership (see Figure 1). Under current law, the foreign partnerships are considered opaque for Dutch tax purposes.[2] Furthermore, the business enterprise of the Fund is allocated to the permanent establishment of the foreign partnerships in the Netherlands. As a consequence, the permanent establishment of the foreign partnership can apply the Dutch participation exemption on income it receives from the fund. Hence, the foreign partnerships are effectively not subject to Dutch taxation.

Under the new law, it is possible that the foreign partnerships will be considered tax transparent for Dutch tax purposes. This means that the permanent establishment and the income from the business enterprise will be directly allocated to the participants in the foreign partnership. Hence, the private individuals that invest through the foreign partnership are deemed to receive income from a Dutch business enterprise. Accordingly, such private individuals may become subject to an effective tax rate of up to 49.5% (2024 rate) or 48% Dutch Personal Income Tax (PIT) for any income that is attributable to the permanent establishment, regardless of whether the income has actually been distributed by the Fund. This could not only result in a high taxation of benefits, but it can also lead to the taxation of benefits that have not yet been received by the investors (phantom income). Furthermore, the underlying Dutch holding company (i.e. the Cooperative in the figure below) may be required to withhold 15% Dutch DWT on distributions to such private individuals, however such DWT should be creditable against the Dutch PIT liability of these individuals.

However, in case such foreign partnership qualifies as a FGR, it would remain to qualify as opaque as a result of the priority rule. Therefore, the new law should then not have an impact in this situation. We note that in this respect it could be considered to obtain an Advance Tax Ruling (“ATR”) from the Dutch Tax Authorities that confirms that the respective foreign partnership qualify as FGRs and therefore should be considered opaque for Dutch tax purposes (i.e. and there should not be any adverse Dutch tax implications as the situation did not change).

Figure 1

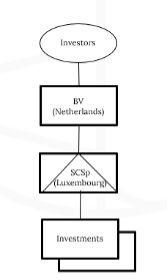

- Dutch investors in foreign Fund

Dutch investors that are investing in a foreign partnership, e.g. a Luxembourg SCSp (the “Fund”), through a Dutch BV (see Figure 2), generally apply the Dutch participation exemption on any income received from the Fund (as the Fund under current law qualifies as opaque). It is expected that the Fund under the new law will be considered transparent for Dutch tax purposes. As a consequence, per 1 January 2025 the BV should take the income from the underlying investments into account directly. Hence, in such case it should be assessed whether the underlying investments qualify for the Dutch participation exemption.

However, if the Fund qualifies as a FGR, it would qualify as opaque (as it does under current law as well) as a result of the priority rule (which could be confirmed in an ATR from the Dutch Tax Authoriteis). Hence, in that case the new law should not have any tax implications.

Figure 2

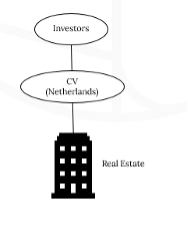

- Real Estate funds

Currently real estate investors (private and institutional investors) often use a tax transparent Dutch CV which directly holds real estate in the Netherlands (see figure 3). However under the new law the CV may qualify as opaque. This would be the case if the CV qualifies as a collective investment fund as defined in Article 1:1 Wft, the participation rights are tradeable (see above) and the CV does not carry on a material business enterprise. These criteria generally would be met in case of Dutch real estate investment CV’s. Accordingly, this real estate investment CV’s might become opaque for Dutch tax purposes per 1 January 2025. Consequently, the investors that are subject to Dutch profit tax (i.e. corporate income tax or personal income tax) are considered to realise hidden capital gains and goodwill that are attributable to them until 1 January 2025. There is no transitional law in this respect.

Figure 3

- Foreign investors holding investments through a Dutch tax transparent CV

A Dutch CV that is used by foreign investors as a pooling vehicle to hold their foreign investments is currently often set up as a transparent entity for Dutch tax purposes. Such an entity often qualifies as a collective investment fund as defined in Article 1:1 Wft. In the case that the participation rights would be tradeable (no inkoopvariant) and the CV does not carry on a material business enterprise, it is expected that due to the priority rule such CV will qualify as an opaque entity as of 1 January 2025.

Figure 4

Take away

The new definition for the FGR and the method to qualify foreign funds for Dutch purposes may lead to a fiscal requalification of the fund by 2025. Any adverse fiscal consequences of a qualification from non-transparent to transparent or vice versa can possibly be avoided by timely restructuring.

We emphasize that it should obviously be analysed on a case-by-case basis whether the new rules will have adverse Dutch tax implications. In most cases it should be possible to mitigate any adverse tax implications, this may however require immediate action.

[1] A definitive decision of the state secretary that is expected to provide clarity on this matter is still awaited.

[2] See example 3 for the potential consequences of the new qualification rules for the Dutch CV.