Clients We Work With

Private Wealth

The right strategy starts with insight

Wealthy families and individuals face complex challenges when it comes to preserving, structuring, and transferring their wealth. Laws and regulations are constantly evolving, and a strategic approach is essential to protect financial and tax interests. At HVK Stevens, we provide tailor-made solutions that match your situation, goals, and ambitions

News Center

News and insights

Stay up to date with the latest developments in the legal, tax, and financial fields. Discover insights, analyses, and updates that are relevant to your business or assets

Fund update and outlook

The Dutch Tax Plan 2026 has been adopted by the Dutch Senate, rendering a number of key tax measures final. In this newsletter we set out the current state of play for funds, focusing on the extended transitional rules, the updated Fund Decree and the recently published consultation proposal.

Belgian holding companies are not entitled to the Dutch dividend withholding exemption

Even if an investment structure has been set up and maintained for genuine economic reasons, it may still be considered ‘abusive’, which could result in the Dutch dividend withholding exemption not being applicable

Marvesa strengthens international position with investment by SD Guthrie International Limited

SD Guthrie International Limited (SDGI) has acquired a 48% stake in Marvesa

Public Consultation on the 28th regime: an EU corporate legal framework and the role of Dutch Civil Law Notaries

Earlier this month the European Commission has published the public consultation on the 28th regime. The deadline for contributions is 30 September

HVK Stevens advises Lorax Capital Partners on strategic investment in MDP

We have advised the Dutch investment vehicle of Lorax Capital Partners on its strategic investment in MDP (Management Dynamics Plus), a leading business process outsourcing (BPO) provider headquartered in Egypt

Ranking ITR World Tax 2025

We are proud to announce that HVK Stevens has once again been recognized as a Top Tier Firm in the ITR World Tax 2025 rankings for General Corporate Tax, Transactional Tax, and Transfer Pricing. This international recognition reaffirms our commitment to delivering high-quality tax services

Stay updated

Subscribe to our newsletter and receive the latest news on legal, tax, and financial developments directly in your inbox

‘HVK Stevens is rising as a tax and legal powerhouse — innovative, collaborative, client-centric.'

About us

Driven, committed, and decisive

Our approach goes beyond professional expertise. We work together in multidisciplinary teams, enabling us to solve complex challenges with tailor-made solutions that truly fit you

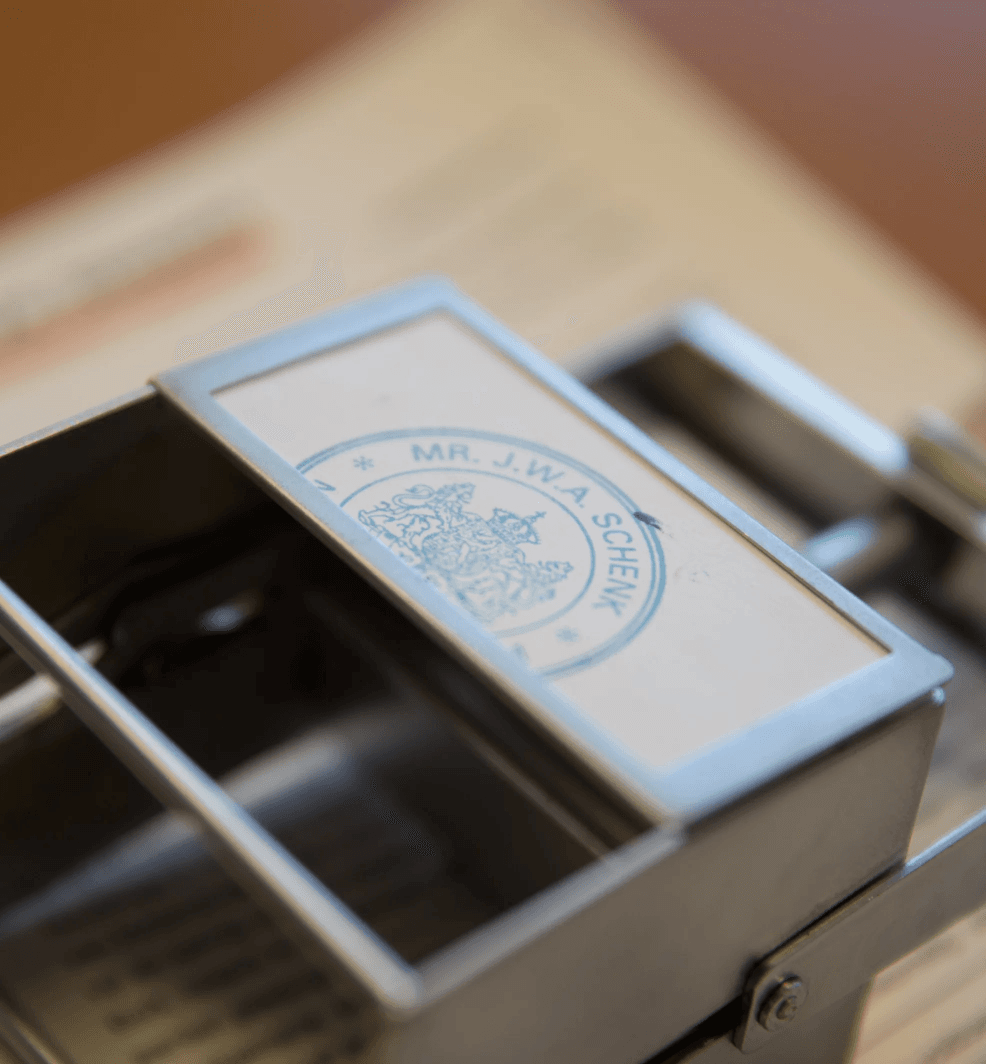

ContactPersonal

For us, everything revolves around a personal connection; we listen, understand, and commit ourselves to making your ambitions a reality. We make the complex simple. No long, theoretical stories, but clear advice and practical answers that help you move forward. That’s how we make a difference

Our peopleContact

Working at HVK Stevens

Grow with us

At HVK Stevens, you are given the space to grow, make an impact, and truly make a difference for our clients. In an entrepreneurial and committed work environment, you collaborate with experts on complex and challenging issues

Working at hvk stevens